Professional Guidelines for Forex Trading Framework

The forex market is a complex and dynamic environment that requires traders to adopt a structured approach to ensure consistency and success. A robust forex trading framework serves as the foundation for making informed decisions. In this article, we will explore the essential components of a professional forex trading framework, including strategies, risk management, market analysis, and continuous improvement. For more detailed insights and resources, visit forex trading framework professional guidelines forex-level.com.

1. Understanding the Forex Market

The forex market, also known as foreign exchange or currency market, is a global decentralized market for trading currencies. Understanding how this market operates is the first step toward developing a successful trading framework. Traders should familiarize themselves with key market participants, trading hours, and the factors that influence currency fluctuations.

1.1 Market Participants

Major participants in the forex market include central banks, financial institutions, corporations, hedge funds, and retail traders. Each group has different motivations and strategies, leading to varied market dynamics. Understanding these participants can provide valuable insights into market movements.

1.2 Trading Hours

The forex market operates 24 hours a day, five days a week. It is divided into three major trading sessions: the Asian, European, and North American sessions. Each session has its unique characteristics, liquidity, and volatility levels, which traders need to take into account when formulating their strategies.

2. Creating a Trading Plan

A well-defined trading plan is a cornerstone of any successful forex trading framework. It should outline your trading goals, risk tolerance, and specific strategies. A trading plan should also include entry and exit criteria, as well as guidelines for trade management.

2.1 Defining Goals

Your trading goals should be realistic and based on your level of experience and risk tolerance. Set specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your trading journey. For example, you might aim to achieve a certain percentage return on investment within a defined timeframe.

2.2 Risk Management

Risk management is a critical aspect of forex trading. Traders should define their acceptable risk levels for each trade, usually expressed as a percentage of their trading capital. Additionally, the use of stop-loss orders and position sizing helps to minimize potential losses and protect capital.

3. Trading Strategies

A variety of trading strategies can be employed in forex trading. The choice of strategy depends on individual preferences, market conditions, and trading goals. Some of the most common strategies include:

3.1 Day Trading

Day trading involves making multiple trades within a single day, with all positions closed before the market closes. This strategy requires a keen understanding of technical analysis and real-time market movement.

3.2 Swing Trading

Swing trading aims to capture short- to medium-term market moves. Traders typically hold positions for several days, relying on technical indicators and price action to identify potential entry and exit points.

3.3 Scalping

Scalping is a short-term strategy focused on making small profits from minor price changes. Scalpers execute numerous trades throughout the day, often holding positions for just a few minutes.

4. Market Analysis Techniques

Effective market analysis is crucial for informed decision-making in forex trading. There are two primary types of analysis: fundamental and technical.

4.1 Fundamental Analysis

Fundamental analysis involves examining economic indicators, geopolitical events, and central bank policies to gauge currency value. Key indicators include GDP, employment rates, inflation, and interest rates. Understanding the broader economic landscape helps traders anticipate market movements.

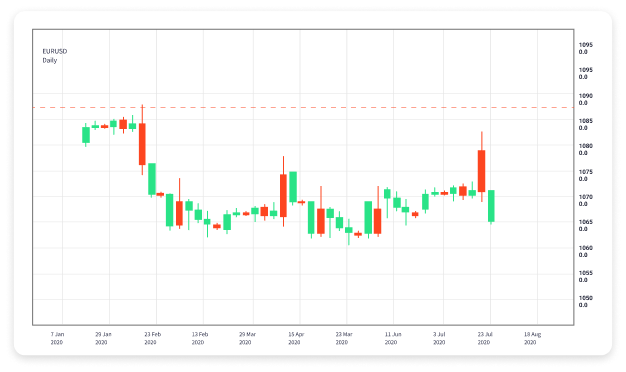

4.2 Technical Analysis

Technical analysis focuses on historical price data, using charts and indicators to identify trends and patterns. Common tools include support and resistance levels, moving averages, and momentum indicators. Technical analysis enables traders to make predictions based on price behavior.

5. Psychological Aspects of Trading

Trading psychology plays a significant role in the success of a forex trader. Emotional discipline, patience, and the ability to handle losses are essential traits for maintaining a positive trading mindset. Traders should develop techniques to manage emotions, such as maintaining a trading journal and practicing mindfulness.

5.1 Maintaining Discipline

Discipline is vital for sticking to your trading plan and not succumbing to impulsive decisions. Traders should follow their strategies consistently, irrespective of market conditions or personal emotions.

5.2 Handling Losses

Every trader will experience losses. It is crucial to accept them as part of the trading journey and to learn from each experience. Analyzing losing trades helps in refining strategies and improving future performance.

6. Continuous Improvement

The forex market is constantly evolving, with new technologies, strategies, and market dynamics. To remain competitive, traders must commit to continuous learning and improvement. Regularly reviewing performance, staying updated with market news, and attending trading seminars can enhance skills and knowledge.

6.1 Performance Review

Conducting regular performance reviews helps traders identify strengths and weaknesses. By analyzing metrics like win/loss ratios, average return per trade, and drawdown, traders can measure their performance and adjust their approaches accordingly.

6.2 Ongoing Education

Investing in educational resources, such as online courses, webinars, and trading communities, can provide valuable insights and knowledge. Engaging with other traders and sharing experiences can foster growth and improvement.

Conclusion

Establishing a professional forex trading framework is essential for achieving long-term success in the forex market. By understanding the market, creating a clear trading plan, employing effective strategies, utilizing market analysis techniques, and continuously improving psychological aspects, traders can increase their chances of becoming successful in this competitive environment. By adhering to these guidelines and remaining committed to growth, traders can navigate the complexities of forex trading with confidence and discipline.