How to Start Forex Trading

Forex trading, or foreign exchange trading, is one of the most popular forms of trading in the financial markets. It offers traders the chance to profit from the fluctuations in currency prices. However, entering the world of forex trading can be overwhelming for beginners. In this article, we will guide you through the fundamental steps to kick-start your forex trading journey. For those interested in local options, you can also check out how to start forex trading Forex Brokers in Argentina, which can provide valuable insights into the regional market.

1. Understand the Basics of Forex Trading

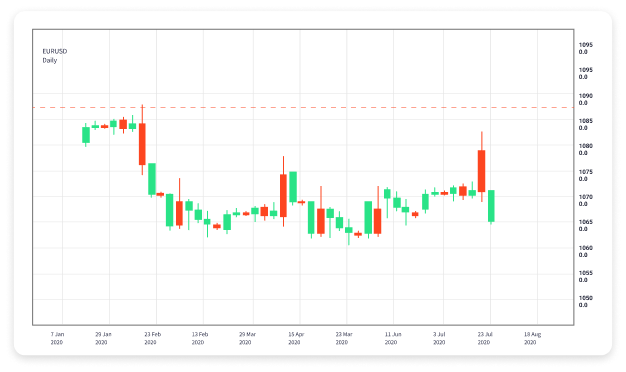

Before diving into forex trading, it is essential to grasp the fundamental concepts. Forex trading involves buying one currency while simultaneously selling another. Currencies are traded in pairs (for example, EUR/USD). The first currency listed is the base currency, while the second one is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

2. Educate Yourself

Education is key in becoming a successful trader. Start by reading books, articles, and resources about forex trading. Take advantage of free online courses and webinars offered by reputable trading platforms. Understanding technical analyses, chart patterns, and economic indicators will provide you with a solid foundation to make informed trading decisions.

3. Choose a Reliable Forex Broker

Choosing the right forex broker is crucial in your trading journey. Look for brokers that are regulated and have a good reputation. Consider the trading platforms, spreads, commissions, leverage, and customer support they offer. Ensure the broker provides access to the currency pairs you are interested in trading. Always read reviews and, if possible, consult with other traders who have used the broker.

4. Open a Trading Account

Once you have selected a broker, the next step is to open a trading account. Most brokers offer different types of accounts, catering to various trading strategies and levels of experience. You will typically have the option to choose between a demo account, which allows you to practice trading with virtual money, and a live account, where you can trade with real money. As a beginner, starting with a demo account can help you gain confidence without risking your capital.

5. Develop a Trading Strategy

A trading strategy is a systematic approach to making trading decisions. It includes your trading goals, risk tolerance, and specific rules for entering and exiting trades. You can develop a trading strategy based on different approaches, including technical analysis, fundamental analysis, or a combination of both. Testing your strategy with a demo account helps you understand its effectiveness before applying it to live trading.

6. Practice Risk Management

Risk management is one of the most critical aspects of successful trading. Always determine how much capital you are willing to risk on a single trade and never risk more than you can afford to lose. Utilize stop-loss orders to minimize potential losses and take-profit orders to secure profits. Diversifying your trades across different currency pairs can also help manage risk.

7. Start Trading with Real Money

After gaining experience with a demo account, you may decide to start trading with real money. Start with a small amount to minimize your risk exposure. Experience the emotions that come with real trading—fear, greed, and excitement. This emotional aspect is often overlooked but is critical to becoming a successful trader. Maintain discipline, stick to your trading plan, and be prepared to adapt to changing market conditions.

8. Keep Learning and Adapting

The forex market is always evolving, influenced by economic data, geopolitical events, and market sentiment. Stay updated with the latest news and trends that can impact currency values. Continuous education through webinars, online courses, and reading current market analysis can enhance your trading skills. Join trading communities where you can share experiences and learn from other traders.

9. Use Technology to Your Advantage

Modern technology plays a significant role in forex trading. Utilize trading platforms and tools that provide charts, technical indicators, and real-time market data. Many brokers offer mobile applications that allow you to trade on the go. Automated trading systems or algorithms can also help execute trades based on predefined criteria. However, always monitor these systems to ensure optimal performance.

10. Evaluate and Reflect on Your Trading Performance

Maintaining a trading journal can help track your trades and analyze your performance over time. Record every trade, including the currency pair, entry and exit points, and the reasoning behind each trade. Regularly review your journal to identify patterns—what works for you and what doesn’t. This reflective practice is essential in refining your trading strategy and improving your overall performance.

Conclusion

Starting forex trading can be a rewarding venture if approached with the right mindset and preparation. By educating yourself, choosing a reliable broker, developing a solid trading strategy, and practicing effective risk management, you can navigate the complexities of the forex market. Remember, persistent learning and adaptation are critical to long-term success. Happy trading!