He acquired confidential information about the brand new sale away from a good “Company B” and you can the new directors are https://proairllc.net/ appointed. Australia features one of the cleanest economic segments around the world and you can maintains so it as a result of rigid court restrictions. Press occurrences, typical announcements, and you may transparent surgery are methods to encourage personal trust. Remaining shareholders informed accelerates their believe in the having an amount to experience occupation.

What exactly is Insider Exchange?

Because these spots in the a public team hold the fresh courtroom and you can moral obligation to the the firm and all of personal shareholders, anyone occupying are usually obliged to place shareholders’ passions just before her. Insider advice can have a deep impression and you may knowing the part out of insider advice inside inventory areas is key. You’ve merely obtained advice your “blockbuster” cancers medicine your organization rallied at the rear of is not bringing approved by the newest Food and drug administration. Actually, everything will go public in just days, as well as the business’s inventory rates often dive. If you operate easily, you could offer your role and stay unaffected… Calculated, your capture your own cell phone and you can control all your family members, urging them to offload their positions, too.

Ties Change Operate out of 1934 – Section 10(b) and you will Laws 10b-5

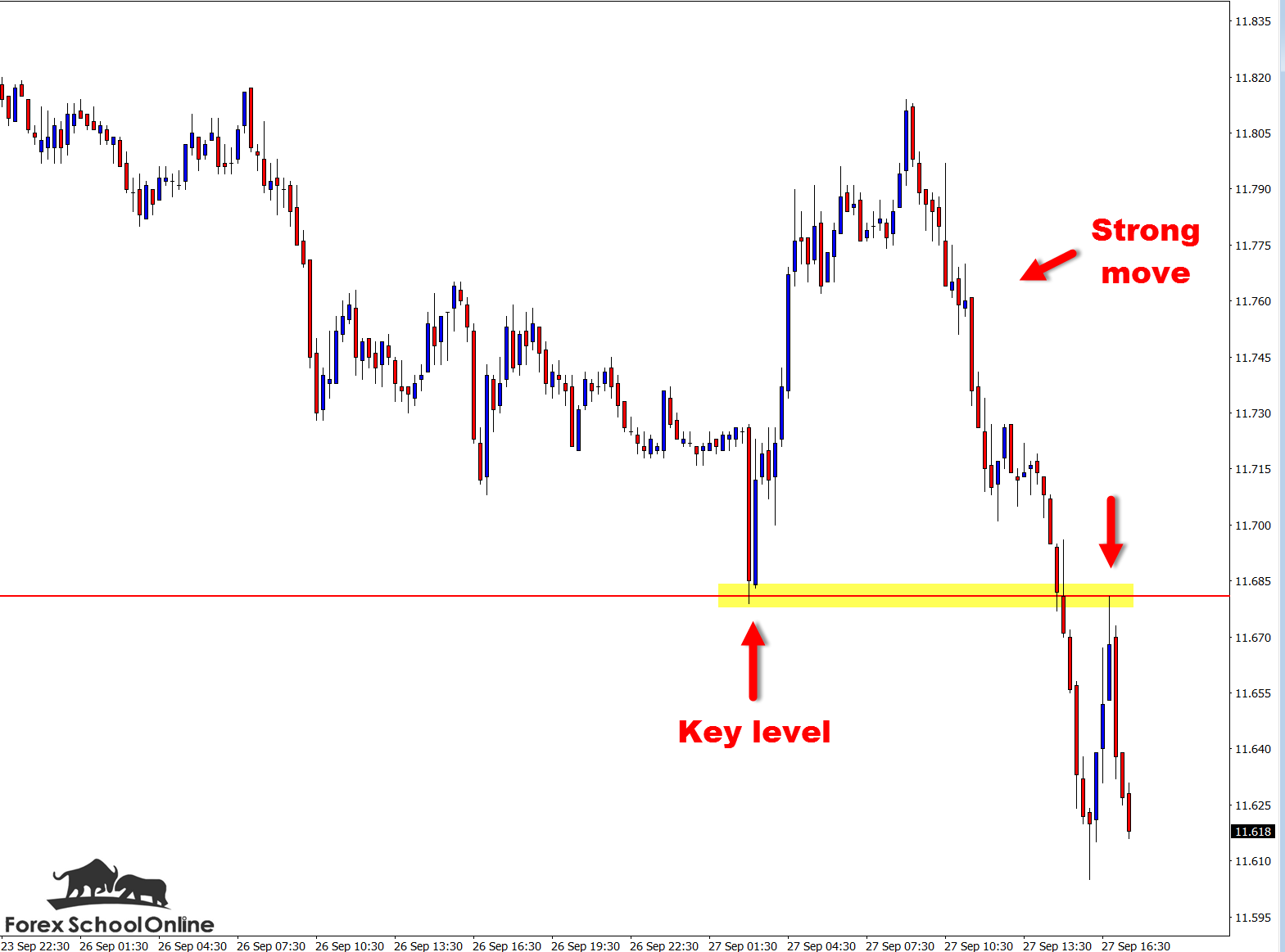

A business executive just who generated quick deals below $5,100 quickly to shop for more $fifty,100000 shares will be sensed unusual. The fresh SEC has systems to position such anomalies and you may check out the them appropriately. One way should be to track straight back the brand new variations to find out if the brand new government filled them after making the exchange.

A typical example of insider trade happens when a professional deal business offers based on knowledge of an upcoming poor income declare that has not yet started expose to the public. In contrast, a legal analogy was whenever a professional orders business inventory during the an unbarred exchange window and reveals the order based on regulating standards, making sure visibility and you will conformity. SAC Money pled bad to help you insider trade fees and are examined $step one.8 billion inside financial penalties.

Insider Trading Laws and Charges

His background in the business has furnished him with rewarding feel on earth. Awogboro is intent on assisting and you can calling as numerous anyone you could as a result of his writing. Ivan Boesky is popular individual that went along to prison to possess insider exchange. Within the extreme situations, enterprises involved in insider trading is also cease functions. Monetary penalties and fees will not surpass three times the gains or losses prevented by the new insider trader.

If you are evidence of insider trading is going to be tough, the new SEC earnestly monitors trading, looking for suspicious hobby. Below Laws 10b5-step one, yet not, a great offender can also be believe an enthusiastic affirmative preplanned change security. Unless you will find a questionable direction regarding the in public expose economic models, it will probably wade beneath the radar.

Underneath the SFA, Area 218 prohibits corporate insiders, such as directors and you can secret shareholders, of trading considering low-societal, matter suggestions. He’s reduced visibility since the authorities features virtually no influence. But not, enterprises generating him or her must make sure insider trade try prohibited.

Peizer “prevented more $a dozen.7 million in the losings” while the he’d sold in get better. For instance, knowing a friends are secretly being discovered at a premium is material; understanding an executive try stepping right here an affect may additionally be issue. A button ingredient of insider trading try “matter nonpublic advice” (MNPI).

Something that’s near the insider exchange range will be be eliminated. Insider trade are illegal whenever a person otherwise organization expenditures otherwise carries a security while they are inside the arms of matter nonpublic guidance. In case your guidance is made societal, it’s no more illegal so you can change involved since you wouldn’t have an unjust advantage. Dirks along with created the useful insider code, and that treats anyone handling a corporation for the a specialist basis since the insiders once they touch low-public record information.

If you are contacted by the a regulating company from positions one to you made, you need to contact a bonds attorneys prior to speaking-to the fresh authorities. To learn more about the protection from insider trading allegations, contact Mark Astarita from Sallah Astarita & Cox at the Draw along with his lovers has portrayed targets in the dozens from insider trade assessment and legal proceeding. The fresh SEC used the newest Regulations 10b5-step 1 and you may 10b5-dos to answer a couple insider exchange issues where courts features disagreed. Rule 10b5-step 1 brings that a person deals based on issue nonpublic guidance if the an investor try “aware” of one’s thing nonpublic suggestions when designing the acquisition or sales. The brand new rule and sets ahead multiple affirmative protections otherwise exceptions so you can liability.